Hi guys! Here I post my trade breakdowns. You can use it to understand how i trade. I mainly use ICT concepts to trade. Updated daily 😀

January 3rd 2026

Trade #1

Trade Rationale: Continuation Entry

Context & Bias

Market printed a 5-minute bearish FVG at 2:45 am NY which instantly got inversed.

Price displaced higher, leaving unfilled 5-minute bullish inefficiencies, signaling continuation intent.

Overall narrative supported continuation. So I was only interested in longs.

Entry Decision: 1-Minute OB vs 15-Minute Rebalance

The optimal approach would normally be to wait for a 15-minute FVG to form and rebalance.

Instead, I executed using the first* valid 1-minute Order Block*, formed immediately after the 30-second inversion.

Why I Took the Aggressive Entry

Strong Draw on Liquidity (DOL)

Higher-timeframe liquidity target was clear and nearby, reducing the need to wait for deeper retracements.

HTF Inefficiency Already Mitigated

The 5-minute bullish FVG had already been tapped, increasing probability of continuation.

Account Risk Profile

These were already-paid-out accounts, making the position psychologically and financially risk-free.

This allowed flexibility to re-enter on confirmation if the initial stop was taken. Narrative Conviction > Entry Precision

Bias was strong enough to justify execution efficiency over perfect location.

Key Takeaway

While patience and HTF confirmation remain optimal, there are situations where narrative strength, liquidity alignment, and account context justify a lower-TF execution without violating risk principles.

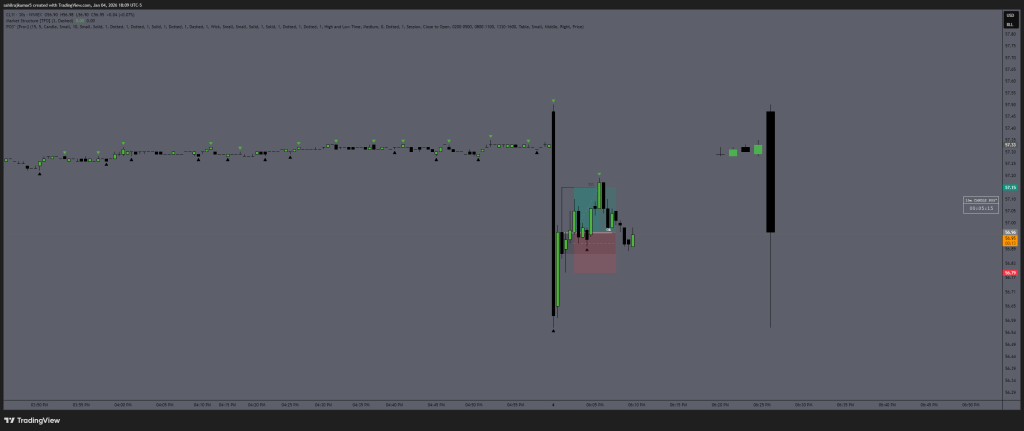

Trade #2

Trade Rationale (Counter–Pullback Continuation)

- Context & Market Narrative

- A 15-minute bearish FVG inversed, while overall market structure remained bullish.

- This indicated the sell-off was corrective, not a true reversal.

- The bearish displacement was treated as a pullback to facilitate higher prices.

- Trigger & Execution

- Once the 15-minute IFVG was tapped, price began to shift structure back to bullish.

- Entry was taken on confirmation of this shift with 2 minis.

- Stop-loss: 8 points

- Target: Above nearby buy-side liquidity

- Why the Tight (8-Point) Stop-Loss

- This trade was against a potential 15-minute pullback continuation.

- Price could easily continue lower while respecting the 5-minute bearish FVG still left unmitigated.

- Therefore:

- If price was truly ready to continue higher, it should not respect bearish PD arrays.

- Any meaningful bearish reaction would invalidate the thesis.

- A tight stop ensured:

- Immediate invalidation if bias was wrong

- No tolerance for hesitation or overlap

- Why Take Only 15 Points (Not Full DOL)

- This account operates under a 25% consistency rule.

- Daily profit on this account is capped at $600.

- Extending to full DOL would:

- Key Takeaway

- Not every trade needs to reach full DOL.

- Account rules + contextual risk dictate exits as much as market structure.

- Tight stops and modest targets are justified when trading against a higher-timeframe pullback.

Trade #3

Trade Rationale (NY Session – 30s OB Short)

- Context & Market Narrative

- A 1-minute FVG was inversed, signaling short-term bearish intent.

- Price had already run into my previous trades’ DOL, taking liquidity and showing signs of distribution.

- After the liquidity sweep, the market began to lose bullish follow-through and started dumping.

- Higher-timeframe objective was a 15-minute bullish Order Block below.

- Trigger & Execution

- Entry was taken on a 30-second Order Block short.

- This was a delivery-style scalp, not a full HTF swing.

- Execution aligned with post-liquidity behavior, not anticipation.

- Why I Was Confident in the Short

- The 9:30 AM NY open did not take out any sell-side lows.

- Failure to raid lows at the open often suggests:

- Buy-side liquidity has already been engineered

- Downside delivery is now more likely

- Price had already completed its liquidity objective above, reducing the need for further upside.

- Initial Targeting Logic

- In NY session, I am comfortable scalping with negative R:R.

- Original idea was a quick 10-point scalp.

- Focus was on: Speed Momentum Immediate reaction

- Why I Extended the Target to 25 Points

- Immediately after entry, price dumped ~8 points in my favor.

- That instant displacement acted as confirmation, not noise.

- Strong immediate follow-through is a signal to:

- Hold winners slightly longer

- Let momentum pay

- I extended the target to 25 points, aiming for roughly $500 per account.

- Trade Management

- Once price moved 10 points in profit, stop was moved to breakeven.

- This allowed:

- Downside exposure with zero remaining risk

- Participation in extended delivery without emotional pressure

- Key Takeaway

- NY session rewards decisive execution and fast confirmation.

- Negative R:R scalps work when:

- Liquidity has already been taken

- Momentum confirms immediately after entry

- Targets should be dynamic, not fixed—price behavior earns extensions.

January 5th 2026

Trade #1

Crude Oil (CL) Impulse Move Scalp

Market opened and CL dumped ~$1 instantly.

After the dump, price pulled back and left a clean high.

Key observation:

Price did not take out the low and instead started pushing higher — that told me we were likely going for ITH liquidity.

All I did was wait for my entry on the 30-second block.

Clean execution, 1:1 RR, no overthinking.

Important note on risk management:

I did not take this trade on my main accounts.

Why?

Those accounts are already at payout, and I’m not risking them in a session where only ~6 candles have printed. Early-session volatility + limited structure = unnecessary risk.

Scalp taken.

Process respected.

Capital protected. 💰

Trade #2

Crude Oil (CL) Continuation Scalp

Market was already rallying and breaking the bearish trendline.

I missed the initial impulse since I was asleep, but once I woke up, I didn’t FOMO—I waited for confirmation.

Price retraced cleanly into a 15m bullish FVG and reacted perfectly off it. That was my area of interest.

Execution issue (on me):

My first intended entry (marked on the chart) didn’t get copied because I forgot to add the contract to my copier. I had to exit and re-enter, which pushed my breakeven uncomfortably close.

After re-entry, price started chopping.

When it finally moved in my favor, I was already up ~$200, which is my breakeven level.

At that point, I had to make a decision:

- Book profits, or

- Hold for the highs given the strong rally context

I chose to hold, because structurally the trade still made sense. I genuinely believe that if my first entry had executed properly, price would’ve hit my TP clean.

Key lesson:

Your copier, broker, and execution setup are variables fully in your control. Double-check them—small operational mistakes can completely change trade outcomes, even when the idea is solid.

Trade idea was valid.

Execution wasn’t perfect.

Lesson logged. 📒